HMRC notes (page 16) ct600-guide

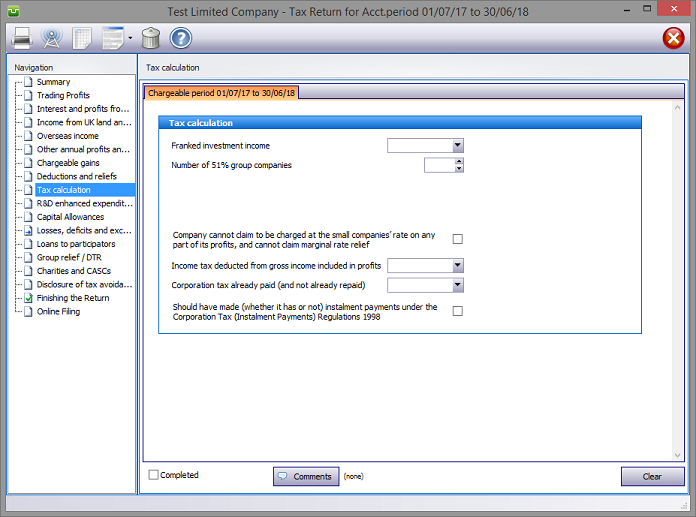

In the Navigation pane click on Tax Calculation and complete as appropriate.

Note, for periods before 1 April 2015:

Check the Company cannot claim to be charged etc. tick box to suppress these actions.

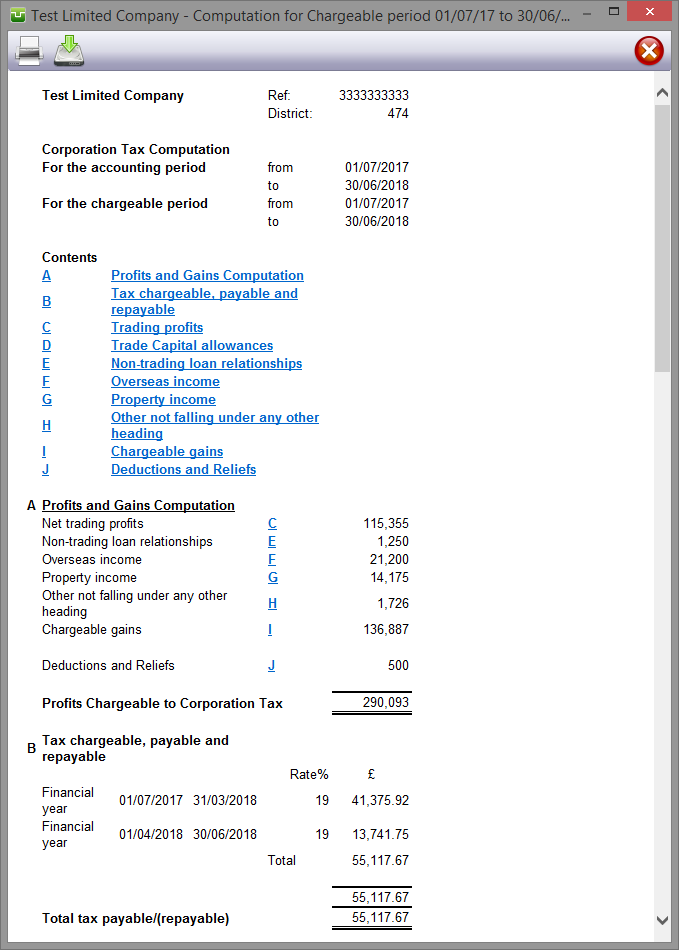

To view the computation click on the Calculate button (third from left on the Toolbar).

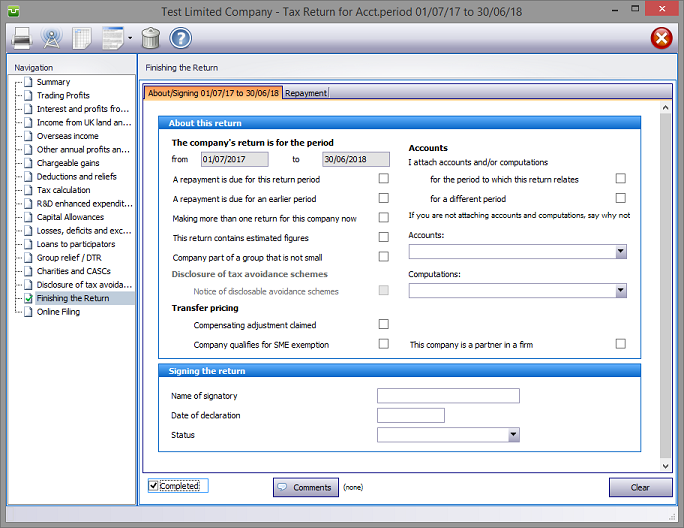

Finishing

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

Entries made via Comments are for information only and do not appear on the return. The first few words of additional information/comments appear to the right of the relevant boxes.

(page 16) ct600-guide

Copyright © 2025 Topup Software Limited All rights reserved.